Sainsbury’s Tu | Sainsbury’s Latest Stock News:

Sainsbury’s, also known as J Sainsbury, holds the position as the second-largest supermarket chain in the United Kingdom.

The company operates multiple businesses, including Sainsbury’s itself, Argos, Habitat, Tu, and Nectar.

It is publicly traded on the London Stock Exchange and is listed as a constituent of the FTSE 100 index.

Sainsbury’s and its subsidiaries are primarily engaged in the sale of groceries, fuel, household goods, and various other products through their extensive network of stores across the UK.

With a wide range of offerings, the company caters to diverse customer needs.

Beyond its core operations, Sainsbury’s is involved in food and drink wholesaling activities, serving as a supplier to other businesses in the industry.

Additionally, it provides banking and insurance services through Sainsbury’s Bank, expanding its reach into the financial sector.

Moreover, the company leverages its expertise in data science, technology, and digital media through its subsidiary Nectar.

This allows Sainsbury’s to offer innovative services and personalized experiences to its customers.

Sainsbury’s plays a significant role in the retail landscape of the UK, serving millions of customers and contributing to the economy.

With its broad range of offerings and diverse business operations, the company continues to adapt to changing consumer demands and technological advancements in order to stay competitive in the market.

Business Model: Sainsbury’s TU

Sainsbury’s TU is a subsidiary of Sainsbury’s, specializing in the sale of apparel and fashion products.

As part of the larger conglomerate, Sainsbury’s employs a diverse business model to generate revenue from various sources.

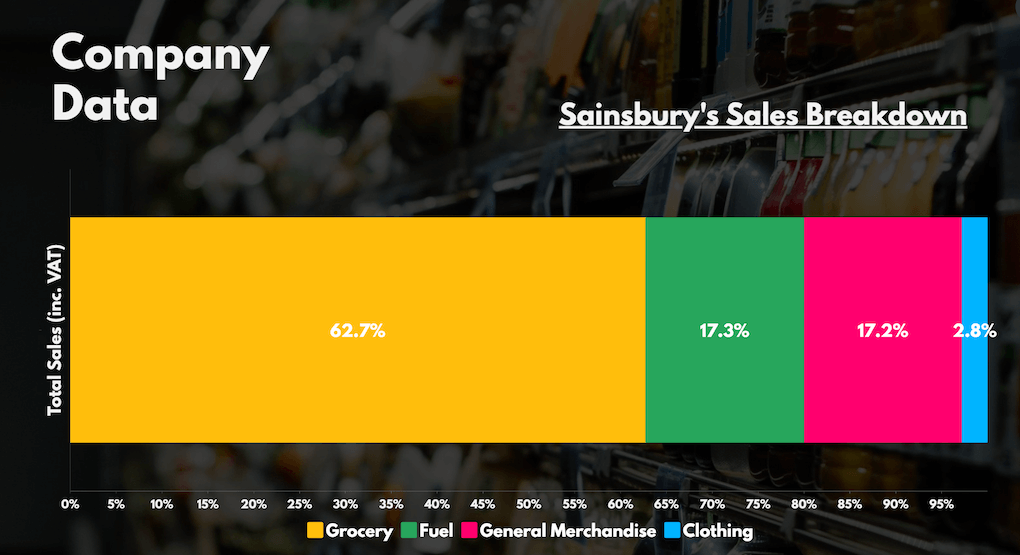

The core revenue stream for Sainsbury’s is its retail arm, which includes the sale of groceries, general merchandise, and household items.

Within this segment, groceries and food products contribute the largest share of sales, followed by fuel sales at Sainsbury’s Forecourts.

The general merchandise category, including products from subsidiary Argos, accounts for an equal proportion of sales.

Additionally, a smaller portion of revenue comes from apparel sales through the subsidiary TU.

With TU, Sainsbury’s offers customers a wide range of fashionable clothing and accessories.

This subsidiary plays a significant role in diversifying Sainsbury’s revenue streams and catering to the fashion needs of its customer base.

By leveraging its established retail infrastructure and strong market presence, Sainsbury’s TU benefits from the conglomerate’s extensive customer reach and distribution network.

The integration of TU within Sainsbury’s business model allows for cross-promotion and synergies across various product categories.

As a conglomerate, Sainsbury’s continues to evolve and adapt to changing consumer demands and market trends.

Through its diverse revenue streams, including the growth potential of TU, Sainsbury’s aims to maintain its position as a leading retailer in the UK market, providing customers with a wide range of high-quality products and exceptional shopping experiences.

Income Breakdown: Sainsbury’s Retail and Financial Services

Sainsbury’s primarily operates a retail business model, generating its profits by purchasing goods in bulk at wholesale prices and then selling them to customers at a higher price to generate a profit.

In addition to its retail operations, Sainsbury’s has a financial services arm that follows a slightly more complex business model.

Sainsbury’s Bank generates income through two main methods. Firstly, it earns net interest income, which is the difference between the interest earned on customer loans and the interest paid on customer deposits.

Secondly, it earns fee income by collecting fees from customers’ credit card spending and foreign currency spreads.

While Sainsbury’s Bank contributes to the overall income of the company, the majority of Sainsbury’s profits come from its retail business, with a particular focus on groceries.

As a result, profit margins in the retail sector are generally considered to be relatively low.

However, Sainsbury’s mitigates this through operating on a high-volume basis, allowing them to generate profits through economies of scale and efficient supply chain management.

By employing this dual business model, Sainsbury’s aims to maximize its revenue streams and diversify its income sources.

The retail segment serves as the foundation of its profits, driven by the sale of groceries and other merchandise, while the financial services arm provides additional revenue streams through interest income and fees.

Overall, Sainsbury’s strategic approach enables it to maintain a balanced income breakdown, ensuring a sustainable business model and continued profitability in the competitive retail market.

Financial Breakdown: Sainsbury’s Debt and Liquidity

Financial Breakdown: Sainsbury’s Debt and Liquidity

While Sainsbury’s balance sheet may appear concerning at first glance, with current liabilities surpassing current assets by almost £4 billion, it is important to note that elevated debt levels are common in the retail industry, particularly among large retailers.

This is because retailers often utilize credit (debt) to purchase fast-moving consumer goods that sell within 30 days or less, categorized as “Trade and Other Payables” on Sainsbury’s balance sheet.

Considering Sainsbury’s large customer base and its ability to meet these obligations, it would be reasonable to discount the £4.88 billion from the current liabilities.

By excluding “Trade and Other Payables,” Sainsbury’s current liabilities shrink from £11.61 billion to £6.73 billion, which can be easily covered by its current assets valued at £7.90 billion.

With this adjustment, Sainsbury’s balance sheet appears much healthier, featuring a debt-to-equity ratio of just 10%, which is comparatively better than its local competitors with higher debt levels.

However, the company still carries £730 million in debt, excluding lease liabilities.

Fortunately, Sainsbury’s liquidity and free cash flow are sufficient to cover its short-term and long-term obligations without difficulty.

Moreover, the debt maturity profile is not a cause for alarm, with repayments spread out evenly over the next decade.

With less than £100 million due this year and less than £1 billion due over the next ten years, Sainsbury’s is expected to have ample liquidity and working capital to repay its debt in the coming years, as long as it continues to generate cash at current levels.

Additionally, the company has approximately £1.6 billion in revolving credit and term loan facilities, providing the option to inject additional liquidity if needed.

Overall, Sainsbury’s net debt to EBITDA ratio currently stands at 3.0x, which is within its target range of 2.4x to 3.0x.

Furthermore, its fixed charge cover is robust at 2.7x, allowing it to effectively meet fixed costs such as leases.

Consequently, Sainsbury’s debt burden is manageable, and the company’s capital utilization strategies are focused on generating further value for shareholders.

Keep in mind that investments can fluctuate in value, and there is a possibility of both gaining and losing money. The taxation of your investments will vary depending on your individual circumstances, and it’s important to note that tax regulations can change over time.