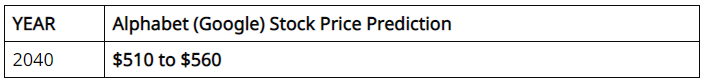

Google Stock Forecast 2040: Based on our analysis, we anticipate that the average value of Google stock (GOOG) could reach approximately $510 to $560 by the conclusion of 2040.

In the event of optimistic market conditions, there is a possibility for the maximum value of GOOG stock to soar as high as $560 by year-end.

Conversely, if a bearish market sentiment prevails, the minimum value of GOOG stock could decline to around $510.

These projections provide insights into the potential trajectory of GOOG stock in the year 2040.

Should I Invest in Google (Alphabet) Stock?

Based on our analysis, investing in Google (Alphabet Inc.) appears to be a favorable opportunity.

With a longstanding dominance in the internet industry, the company has consistently delivered profitable returns for investors in the technology sector.

Google’s strategic positioning allows it to leverage current technological advancements and continue expanding its influence in the foreseeable future.

Notably, market forecasts indicate a positive trajectory for Google’s stock value, signaling optimism among industry insiders.

Considering these factors, it seems like a robust investment option worth considering for prospective investors.

The turning point came when the company delved into the realm of artificial intelligence (AI).

Google’s recent AI event received much more positive feedback compared to its previous one, where an error by the Bard chatbot had been showcased.

Since the successful second AI presentation, Google’s stock has been on an upward trajectory.

Now, what should shareholders make of all this?

First and foremost, it must be questioned whether the immense amount of money pouring into companies mentioning AI at every opportunity during earnings calls is being allocated wisely.

In our opinion, NVIDIA (NASDAQ: NVDA) is currently overpriced, and other tech companies are also becoming relatively expensive, although to a lesser extent.

However, Google’s valuation is not outrageous, despite recent buyers potentially having questionable motivations.

Judging by multiples, GOOG is only slightly pricier than the S&P 500, which trades at a 22 times earnings multiple.

In comparison, many other prominent tech companies carry significantly higher premiums above the benchmark.

For instance, NVIDIA is presently trading at 29 times sales and 95 times earnings.

If you are contemplating buying a stock caught up in the AI frenzy of 2023, it would be beneficial to choose one that is not excessively overvalued.

In this regard, Google seems to fit the bill.

While the company is valued at a premium, it is not at a level that defies rationality.

Additionally, Google continues to demonstrate positive revenue growth, and its earnings did not experience substantial declines in the last quarter.

These indicators collectively suggest that it is a stronger company compared to some of its competitors.

Moreover, Google’s competitive position in the market supports the argument that it presents good value at present, which will be the primary focus of this article.

Is Google (Alphabet) a Good Long Term Stock ?

Alphabet Inc.’s (GOOG) stock is considered a promising investment opportunity for long-term profitability.

Experts anticipate that the price of the stock will continue to rise in the coming years, making it advisable to hold onto the stock for an extended period of time.

In fact, analysts have given GOOGL stock a consensus Buy recommendation for long-term projections.

This suggests that the stock is expected to perform well over a longer period of time and has the potential to provide significant returns on investment.

Therefore, investing in Alphabet (GOOG) stock for the long term could be a wise decision for investors seeking profit opportunities in the stock market.

The biggest reason for thinking that Google is at a reasonable valuation today is the fact that it has a strong competitive position.

Google Search

So let’s talk about Google search.

There was some talk about Bing’s chatbot posing a threat to Google’s dominance in search.

Bing’s chatbot, built on ChatGPT, had internet access and could handle current events.

People started worrying about Google’s market share because Bing combined AI with search, which is a popular trend these days.

But hey, here’s the good news. Google hasn’t actually lost any market share.

Bing’s peak was back in October 2022, and since then, Google has made small gains.

In fact, Google still controls a whopping 86% of the search market.

Now, I know some people argue that Bing might eventually beat Google Bard in the chatbot battle, and maybe they will.

But here’s the thing, even if that happens, Google is holding its ground in search.

Maybe these chatbots aren’t as vital to search as we thought.

If that’s the case, Google could quietly push Bard aside and focus on its core search product without the high costs of running chatbots.

Video

YouTube is still the king of online video, with a massive 75% market share.

Sure, TikTok and Instagram (owned by Meta Platforms) are considered competitors, but mostly in the short-form video space.

They might grab some attention here and there, but they can’t really compete with YouTube’s strength in long-form videos.

The average YouTube video is around 11.7 minutes long, way longer than what you’ll find on TikTok and Insta.

So, if you’re looking for interviews, video essays, or full music videos, YouTube is where it’s at.

Lastly, smartphone operating systems.

Google is technically number one in terms of installations, although Apple takes the lead in revenue because its app store generates more sales than the Play Store.

Apple dominates the high-end market, especially in the wealthier U.S. market, where people are willing to spend more on apps.

But here’s the thing, Google has the low-end of the smartphone market locked down.

As long as people want affordable smartphones, Android phones will have a market.

To sum it up, Google’s competitors may gain some ground, but Google will still stand strong.

Google continues to remain the top choice. Even if TikTok and Instagram dominate short-form videos, YouTube still rules in long-form videos.

And even if iPhone strengthens its position in premium phones, Google will still be on top in the budget phone segment.

Google has so many advantages that it can continue being a highly profitable company.

And that’s not even considering Google Drive, Gmail, the successful cloud segment, or any of their other ventures.

Potential Risk

When it comes to Google, it’s clear that they have a strong competitive position and their valuation isn’t too steep compared to other tech giants.

But here’s a risk to keep an eye on:

Anti-trust issues.

Google’s dominant position often lands them in legal trouble.

The Department of Justice (DOJ) is currently working on a lawsuit against them, and they were recently sued for a hefty $4 billion in the EU.

Google has already lost one appeal in that case, so there’s not much room left before they have to pay up.

When a company has multiple dominant subsidiaries like Google, regulators tend to scrutinize them more closely. So, it’s important for investors to watch out for the anti-trust risk that Google faces.

That being said, overall, GOOG is still a great stock.

With its strong competitive position and a reasonable valuation compared to other tech giants, I personally plan to hold onto my Google stock for the foreseeable future.

POPULAR: AOC Net Worth – What is Alexandria Ocasio-Cortez’s Net Worth?